Technical & Financial Assessment of DHA City Karachi (DCK)

Residential Development, Karachi, Pakistan

Advisory Services for major city-level development spread over 11,640 Acres on the main Superhighway

PROJECT DESCRIPTION

DHA City Karachi is a sustainable green smart city project located about 56 km from Karachi. Planned on 11,600 acres, this landmark project consists of multiple residential phases with high & medium-income housing, major commercial precincts for hospitality, office, retail, etc; and top-quality recreational components. This self-contained development is complemented with all requisite amenities including schools, colleges, clubs, community centers, parks, playgrounds, sport complex, mosques, and healthcare facilities.

Promag was engaged for this project as a part of a consortium led by KPMG, Taseer Hadi & Co. The engagement referred to as “Project Optima’ was undertaken with a primary objective of assessing the technical and financial challenges faced by the ongoing development of DCK and to propose strategies to mitigate the latter. Key elements of the engagement included the review of the data/information provided by DHA and proposing changes to the existing documents and plans of DCK in line with the Client’s objectives. This included:

- An overview/study of the available Project Master Plan and Concept Design.

- High-level review of current and future Development Strategy & Plans.

- Review of the available Project Financial Plan & Marketing Plan and study its linkage/relationship with the overall Development Plans.

- Review of the welfare commitments along with the commercial sales.

- Review of the existing cost parameters and prepare and updated high-level cost estimate for the Project based on the available conceptual plan.

- Undertaking a high-level estimation of revenue potential from various components and activities of the Project.

- Seek advice from DHA on the current and future commitments and requirements of development works at site as well as marketing inflows/receipts already committed.

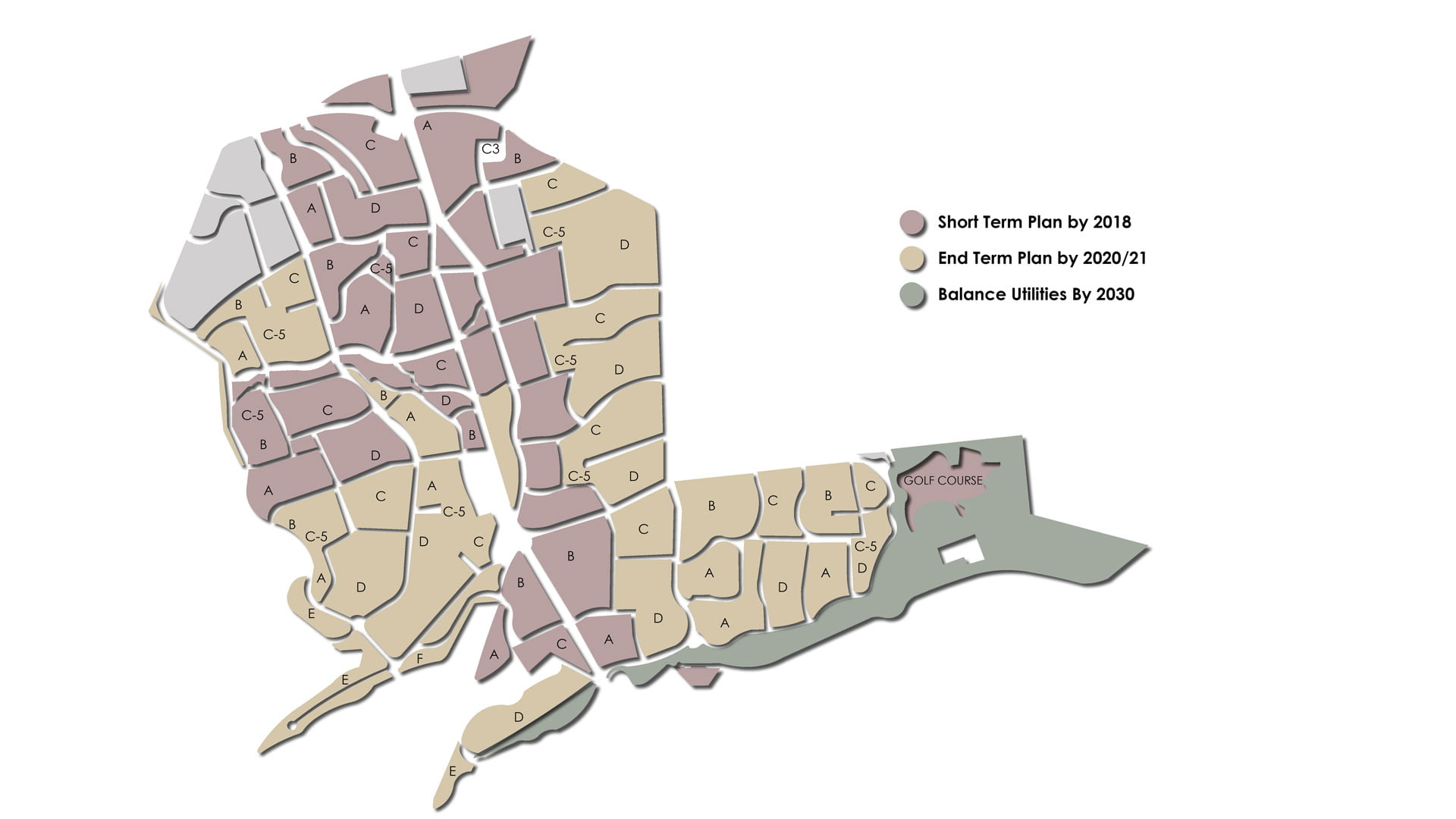

- Review of the existing initial Phasing Plan and prepare an updated initial Phasing Plan.

- Carry out an option analysis describing various modes in which the Project may be implemented including possible procurement routes/investment options including conventional construction contracts and/or private sector participation.

- SWOT analysis for the development of the Project.

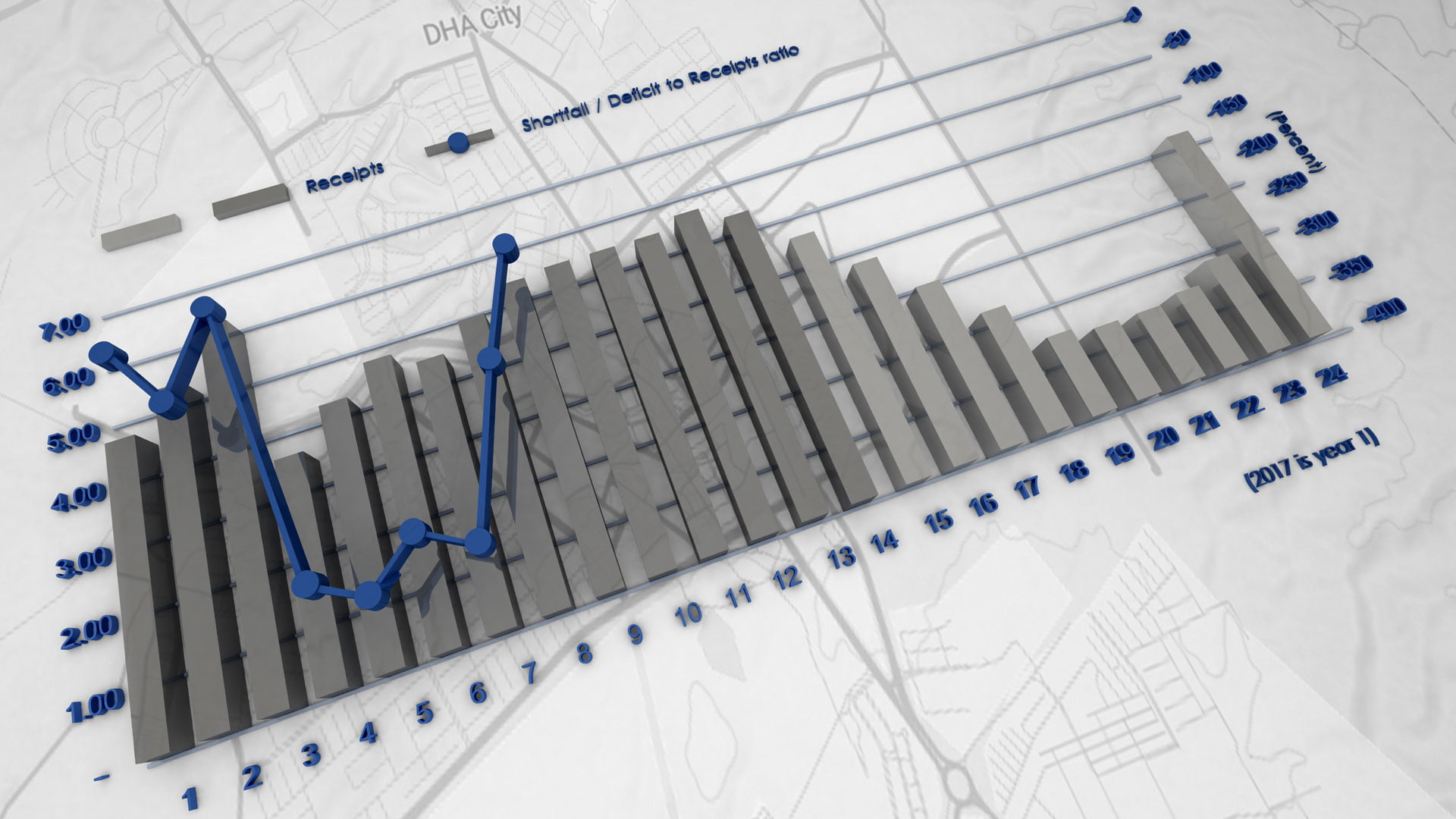

- Develop a high-level financial model for the purpose of ascertaining the viability assessment of the overall project.

- Suggest possible plans to recover development expenditure through development charges from buyers and advise on any financing/funding requirements to bridge the inflow-outflow gap based on the financial model.

- Advise on broad-based strategies for possible value enhancement options with a view to economize/optimize development cost.

- Review of existing contractual documents/construction contracts with respect to possible contractual regime for subsequent project implementation.

- Identify potential options of private sector participation and their impact on financial/commercial viability and subsequent transaction structures.

- Study and suggest measures for better cost benefit management for DCK’s maintenance/up gradation and organizational outlays.

- Recommend mid and long-term strategies for maximization of returns on available land bank of the Project.

PROJECT HIGHLIGHTS

11,640 Acres

Project Area

PROJECT GALLERY