Pakistan Railways

Real Estate Projects – Karachi Division

Viability Assessment, Transaction Advisory & Structuring of Prime Real Estate owned by Pakistan Railways

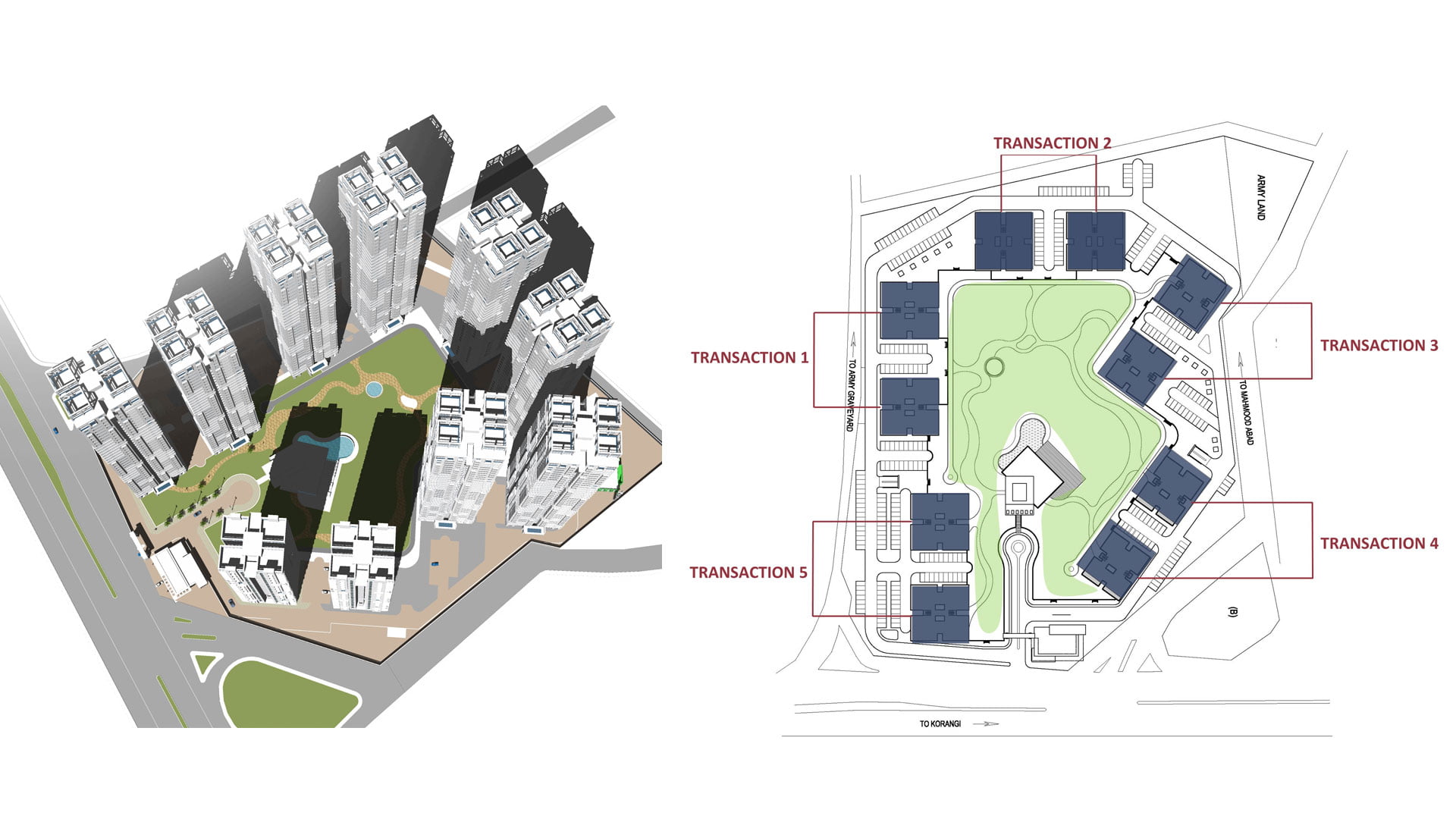

PROJECT DESCRIPTION

While facing financial challenges as an organization, Pakistan Railways (PR) remains one of the largest land stock owners, in the country. Much of this land is strategically located in the prime areas of urban centres, which have grown around the major north-south rail link of the country and its train stations. It was realized that developing selected parcels from PR’s property portfolio through transparent Public Private Partnership (PPP) based structures could become a vital source of both fixed and perpetual income streams for PR. Such income could be utilized to assist PR in both their much-needed capital expenditure for infrastructure upgradation as well as requisite subsidies for the O&M function.

The Advisory consortium, which was led by Promag and included financial consultants KPMG Taseer Hadi & Co. and legal consultants Mandviwalla & Zafar, was assigned to assist PR in their Real Estate Development Program for the utilization of its property stock, initially in the Karachi Railway Operations Division. The assignment included assistance in Formulation of Strategy & Policy Frameworks, Land-use Allocation, Master Planning, Feasibility Studies, and Transaction Structuring leading to developers’ selection for the Program.

- High-level analysis of Pakistan Railways’ land banks for identification of development/ commercialization potential

- Formulation of policy framework and real estate development strategy

- Prioritization of properties for an overall implementation program

- Master planning, feasibility study and transaction advisory of properties based on assessed potential

- Structuring of packages for private developers

- Assistance in transaction execution/evaluation leading to selection of developers

The consortium carefully suggested a well-conceived approach/policy framework for PR to pursue development projects with private sector participation. The scope of work for the consortium included the following;

Formulation of Policy Framework & Development Strategy

- Review of Existing Land Banks of Karachi RO Division

- Assessment of Commercial/Development Potential of Land Assets

- Assistance in Formulation of a Policy Framework for Development

- Assistance in Formulation of Real Estate Development Strategy

- Basic Land-use/Development Plan

- Overall Phasing Plan/ Implementation Program

- Assistance in Selection of Properties for Priority Development

Project Planning & Feasibility Study

- Compilation of Available Data for Selected Properties

- Master Planning/Conceptual Design

- Preliminary Cost Estimation

- Stakeholder Identification

- Technical Viability Assessment

- Financial/Commercial Viability Assessment (including cost & revenue estimation, project cash flows, financing/funding requirements)

- Potential Investor/Developer Interest Report

- Feasibility Study Report

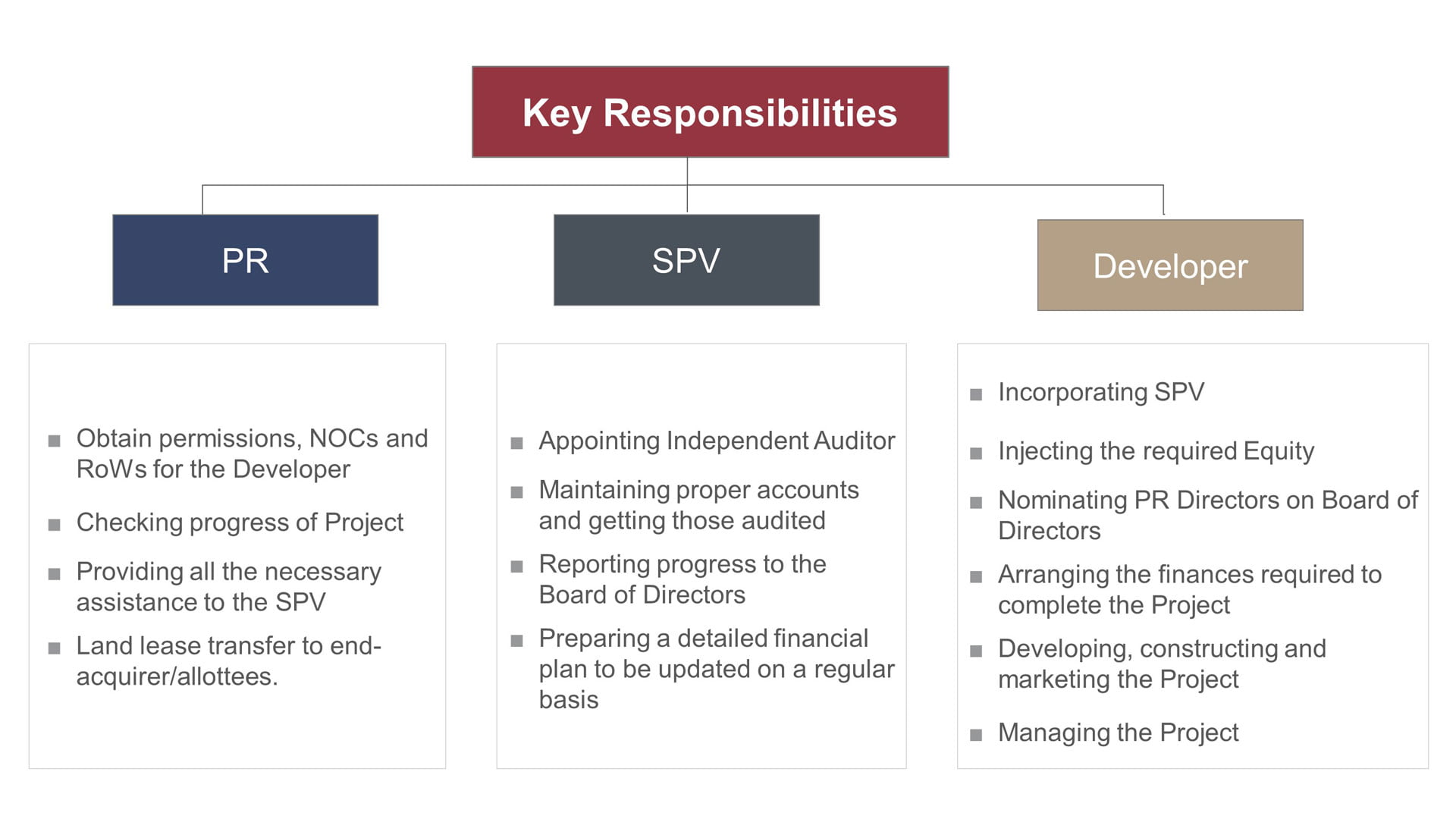

Transaction Structuring & Execution

- Project Brief & Information Memorandum

- Request for Proposal (RFP)

- Draft Development Agreements

- Compilation of Bidding Documents

- Pre-qualification Criteria & Evaluation

- Bid Process Formulation

- Pre-bid Meetings & Bid Clarifications

- Development Bid Evaluation

- Assistance in Negotiation & Selection of Developers

KEY SERVICES

- Development Strategy Formulation

- Master Planning & Project Conceptualization*

- Identification of Best Use of Land

- Residual Value Assessment for Land

- Priority of Development Projects

- Feasibility Study / Assistance in Viability Assessment

- Development Scheme Design Advice

- Project Budgetary Analysis + Cash Flow Planning

- Planning Scope, Phasing & Project Delivery Method

- Assistance in Transaction Advisory

- Advice on Project Structuring on PPP based models

*Services undertaken in collaboration with affiliate Group Company LOCii INC.

PROJECT HIGHLIGHTS

Viability Assessment

Advice on PPP Based Transactions

Project Structuring

PROJECT GALLERY